Salesforce Financial Services Cloud: Enhanced Clarity with AbstraLinx Diagrams

October 18, 2024

Salesforce Financial Services Cloud (FSC) empowers financial institutions to deliver personalized services and streamline operations. In this blog, we’ll explore what Salesforce Financial Services Cloud offers, and how our tool, AbstraLinx, can play a vital role in simplifying the implementation of FSC, helping teams visualize and document the cloud’s architecture for faster, more efficient setups.

Table of contents

- What is Salesforce Financial Services Cloud?

- Key features of Salesforce Financial Services Cloud include:

- Salesforce Financial Services Cloud Data Model Diagrams designed with AbstraLinx

- Enhances your FSC implementation, Saves Time and Reduces Complexity: Data Dictionary and Model Documentation Generated by AbstraLinx

What is Salesforce Financial Services Cloud?

Salesforce Financial Services Cloud is a specialized version of Salesforce CRM, designed specifically for financial institutions. Whether you’re in banking, wealth management, insurance, or mortgage, FSC provides a 360-degree view of each client, allowing for highly personalized and proactive engagements. By consolidating data across different channels, FSC enables financial advisors, bankers, and service agents to offer tailored advice and services to clients.

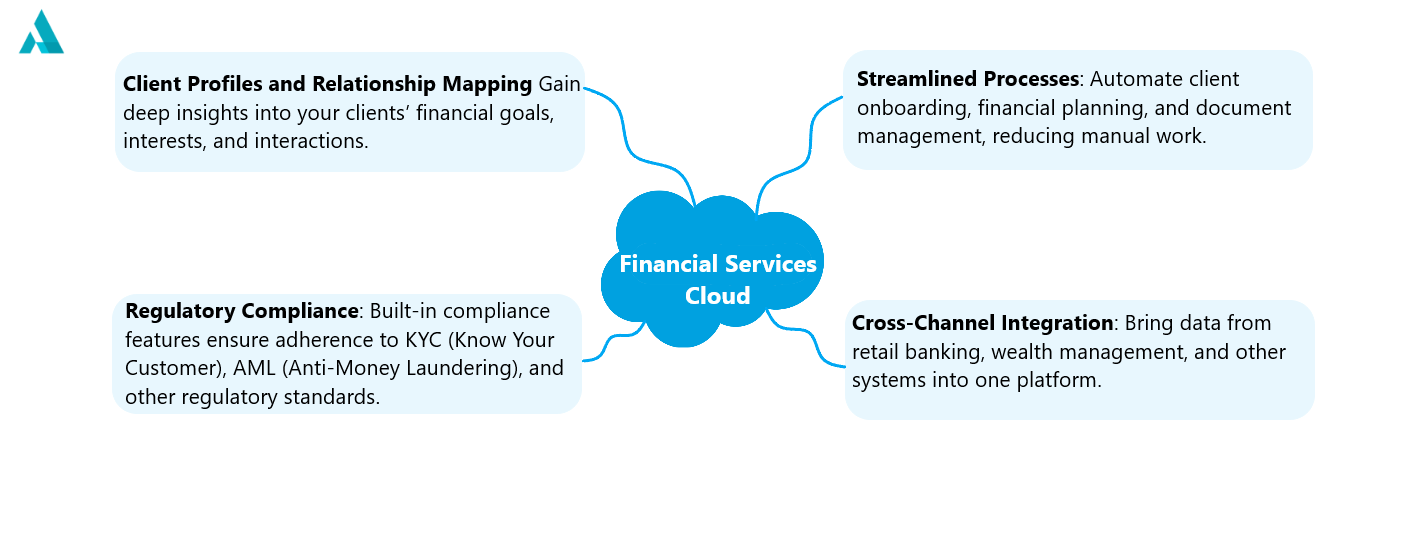

Key features of Salesforce Financial Services Cloud include:

Salesforce Financial Services Cloud Data Model Diagrams designed with AbstraLinx

To better illustrate how Salesforce Financial Services Cloud supports various functions within financial institutions, we’ve created a series of diagrams using AbstraLinx. These diagrams help simplify the relationships between different objects in FSC, showcasing how data flows and interacts across departments.

Below are the key areas we’ve focused on, along with the corresponding data model diagrams:

Enhances your FSC implementation, Saves Time and Reduces Complexity: Data Dictionary and Model Documentation Generated by AbstraLinx

As part of managing Salesforce Financial Services Cloud, generating and maintaining an accurate data dictionary and model documentation is crucial. With AbstraLinx, you can automate the creation of these essential resources, saving time and ensuring consistency.

With AbstraLinx, you can:

Generate Documentation and Data Dictionary: AbstraLinx automatically generates comprehensive documentation and data dictionaries, which are crucial for compliance, training, and future modifications. This ensures that no details are overlooked—especially important for financial institutions that must adhere to strict regulatory requirements. See our example of documentation and data dictionary for Salesforce Financial Services Cloud.

Visualize the cloud as diagrams: AbstraLinx creates intuitive visual representations of your Salesforce data models, making it easier for IT teams and administrators to align on configurations and customizations. This helps teams better understand object relationships and streamline the implementation process.

Explore the capabilities of AbstraLinx and see how it enhances your Salesforce Financial Services Cloud experience. Download the project and start your free trial today!

.

Salesforce Financial Services Cloud empowers institutions to deliver personalized experiences and optimize operations. AbstraLinx enhances this by simplifying data models, generating automatic documentation, and streamlining FSC implementation. Together, they boost productivity, improve customer satisfaction, and ensure compliance, all while saving time.

Read more related posts

Subscribe To Our Newsletter

Subscribe to our email newsletter today to receive updates of the latest news, tutorials and special offers!

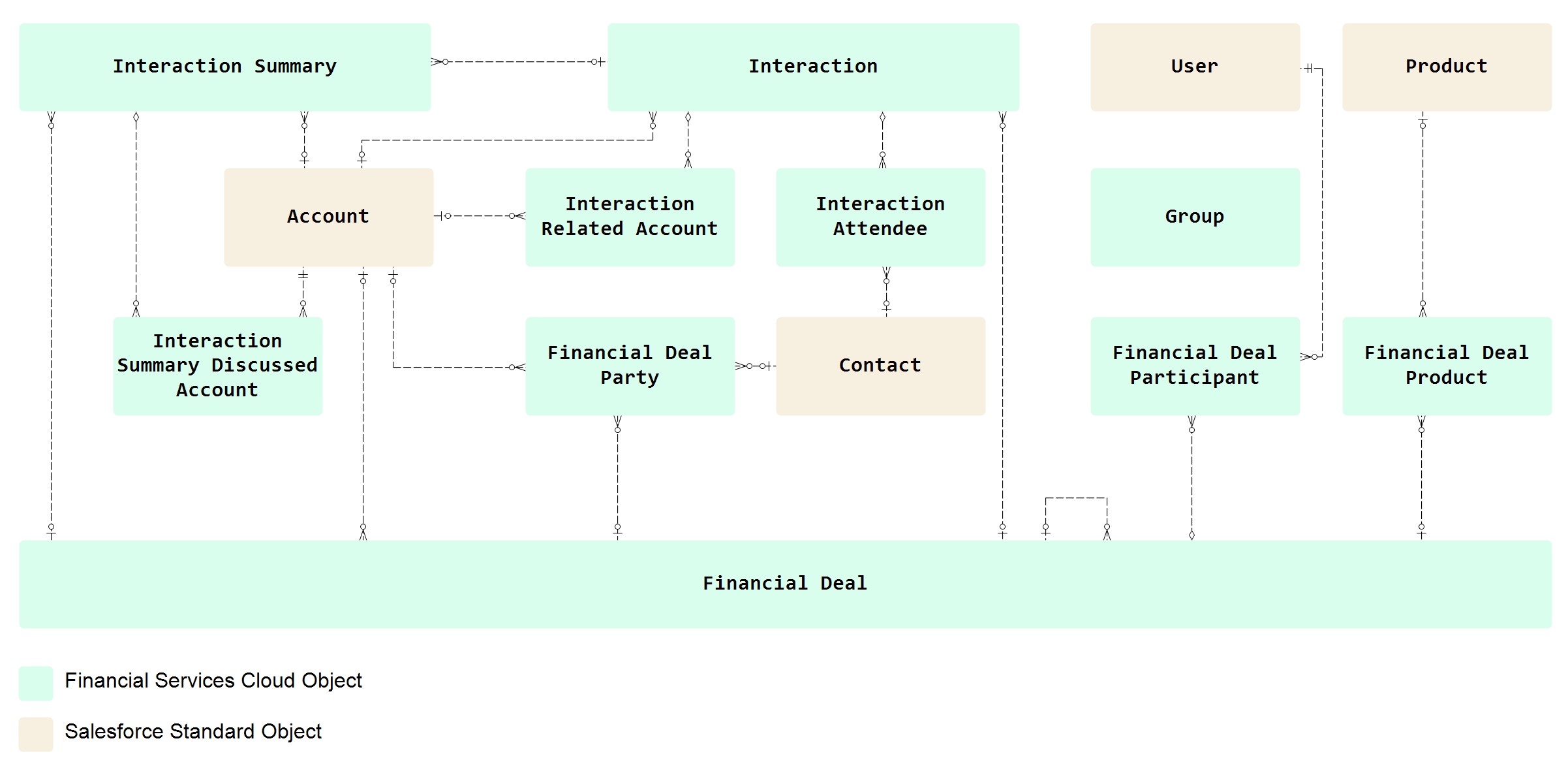

This diagram represents how business clients engage with financial institutions through various touchpoints in Salesforce Financial Services Cloud. It maps out the relationships between business accounts, financial products, and key participants, such as account managers and advisors. The focus is on tracking client interactions, identifying opportunities, and managing business relationships, all within a unified platform to enhance client service and business growth.

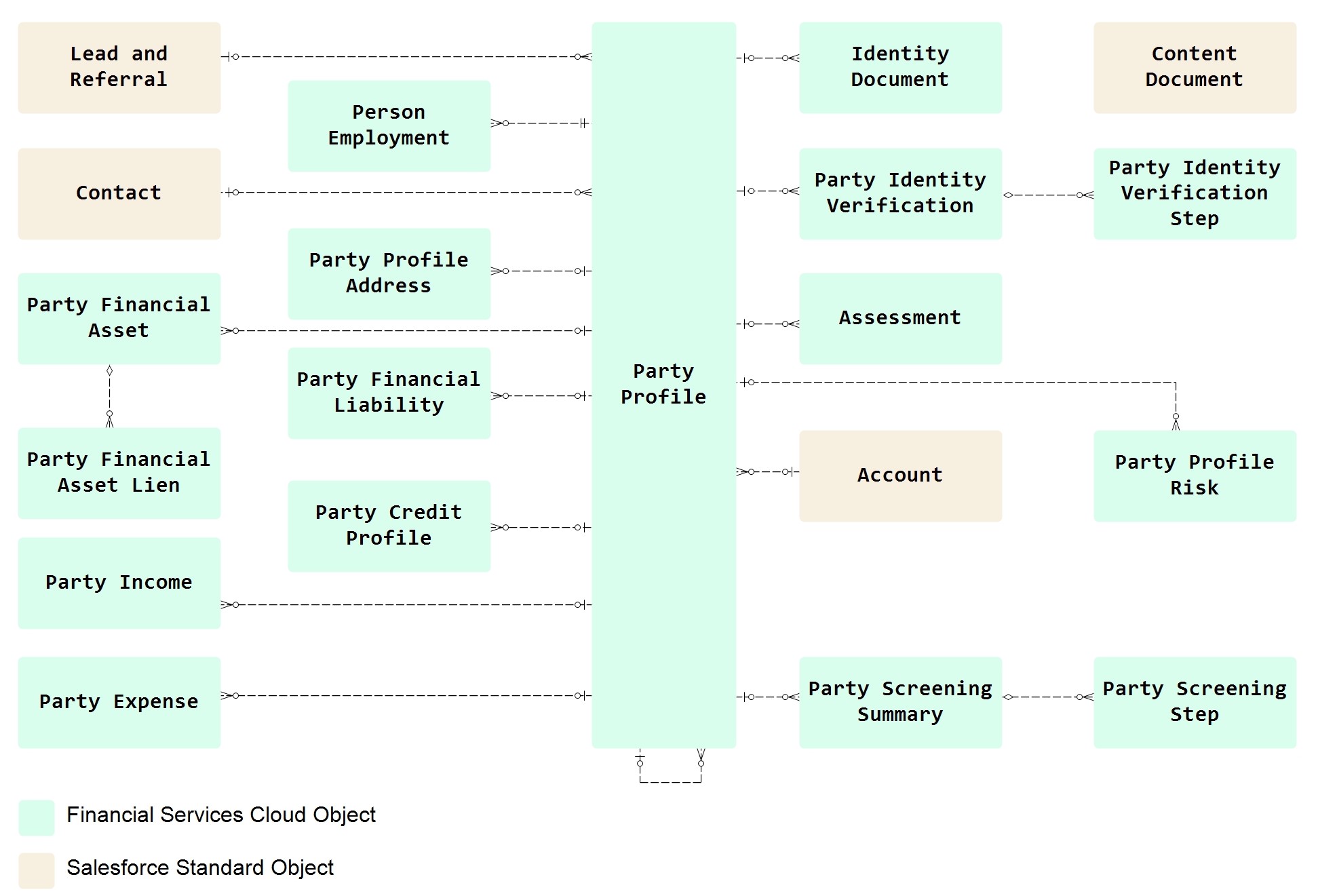

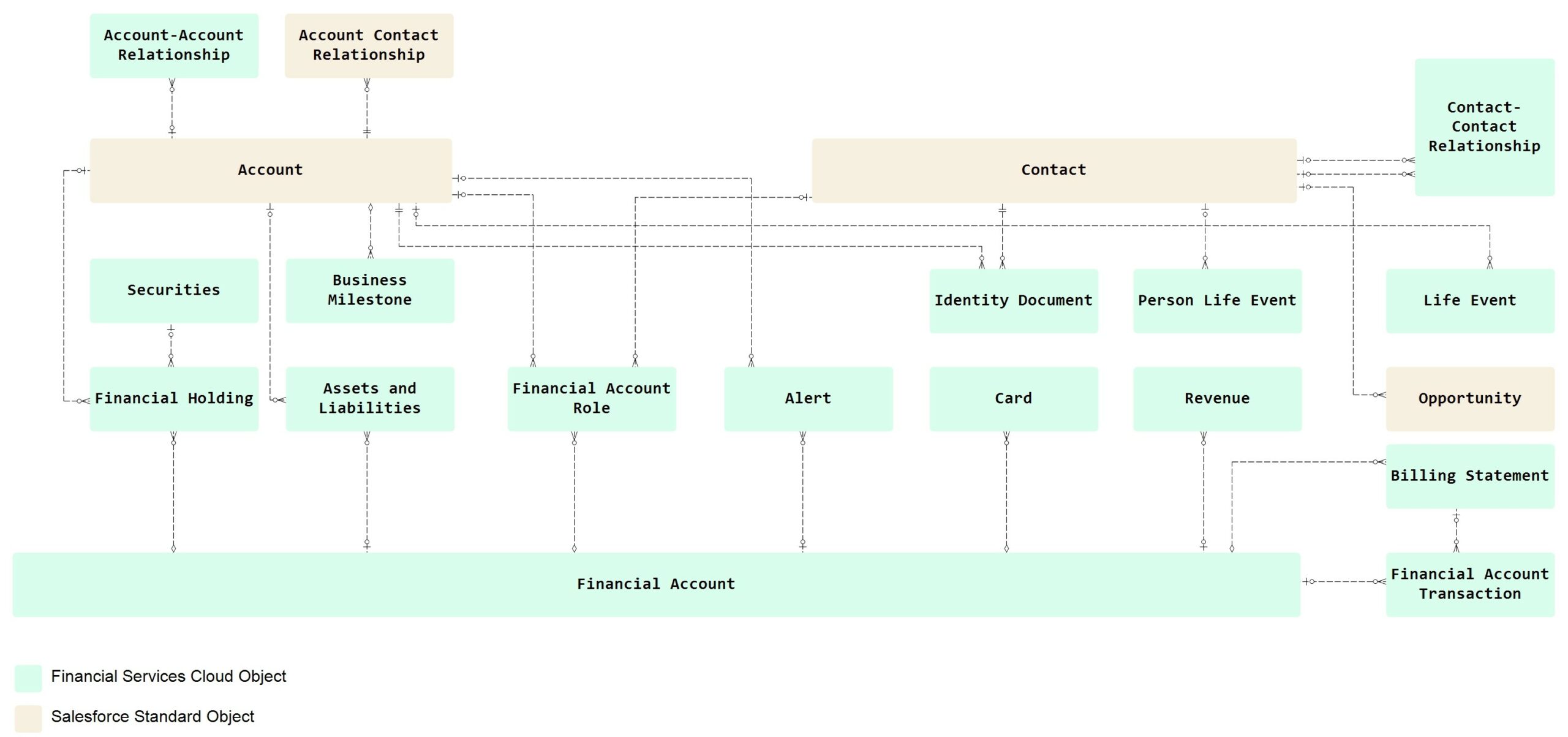

This diagram represents how business clients engage with financial institutions through various touchpoints in Salesforce Financial Services Cloud. It maps out the relationships between business accounts, financial products, and key participants, such as account managers and advisors. The focus is on tracking client interactions, identifying opportunities, and managing business relationships, all within a unified platform to enhance client service and business growth. The Customer diagram showcases the 360-degree view of individual clients, including their personal profiles, financial accounts, and interactions. It highlights the various data points Salesforce Financial Services Cloud consolidates—such as income, liabilities, assets, and employment details—providing a comprehensive overview that financial advisors can use to offer personalized services and recommendations.

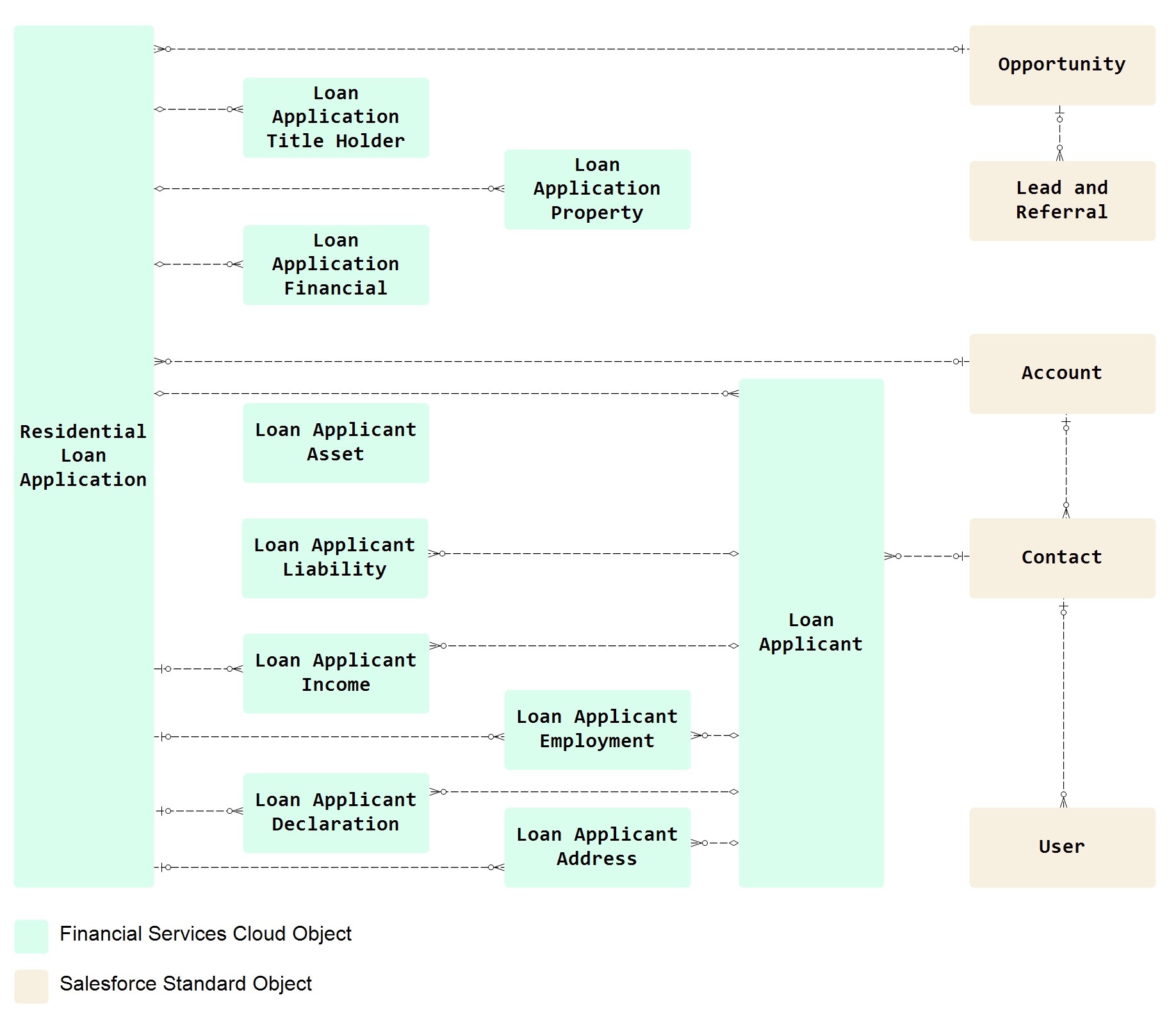

The Customer diagram showcases the 360-degree view of individual clients, including their personal profiles, financial accounts, and interactions. It highlights the various data points Salesforce Financial Services Cloud consolidates—such as income, liabilities, assets, and employment details—providing a comprehensive overview that financial advisors can use to offer personalized services and recommendations.

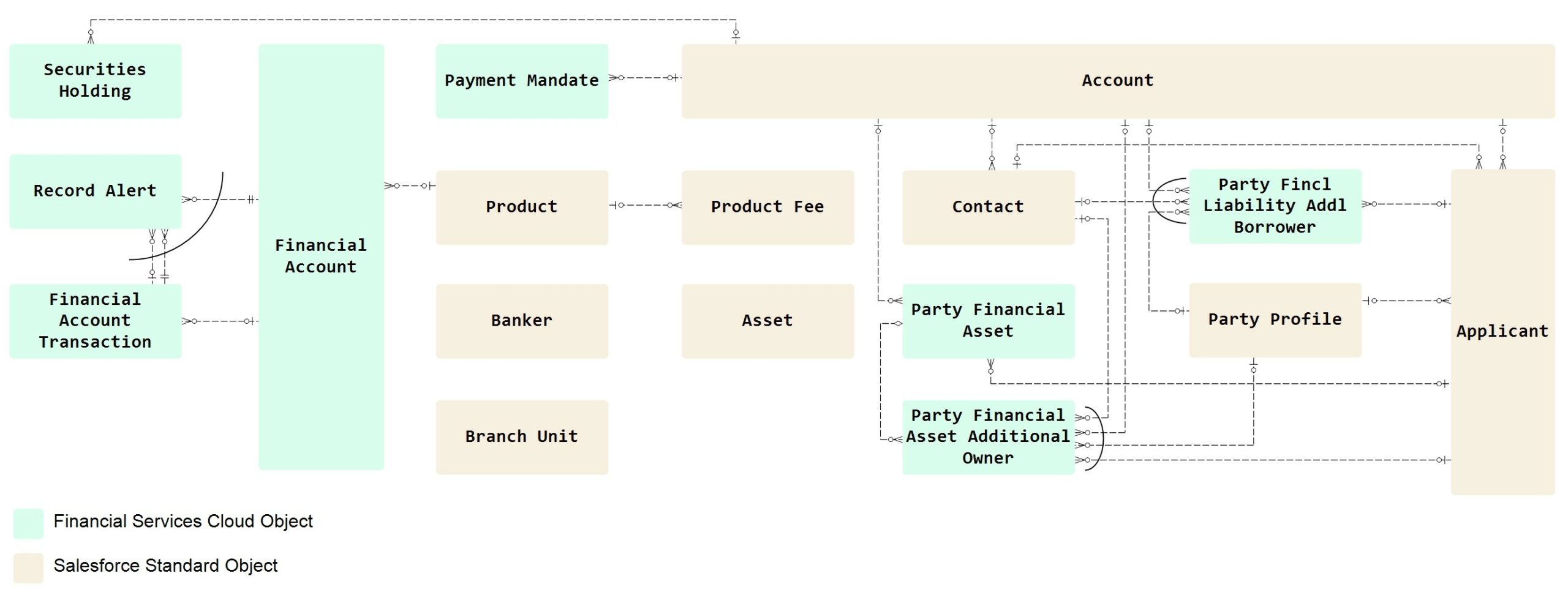

This diagram focuses on the structure and management of financial accounts within Financial Services Cloud. It illustrates how different entities like securities, transactions, alerts, and account roles are linked to a single financial account. It also shows the relationships between the financial account and associated products, assets, and parties, ensuring full transparency in account activities.

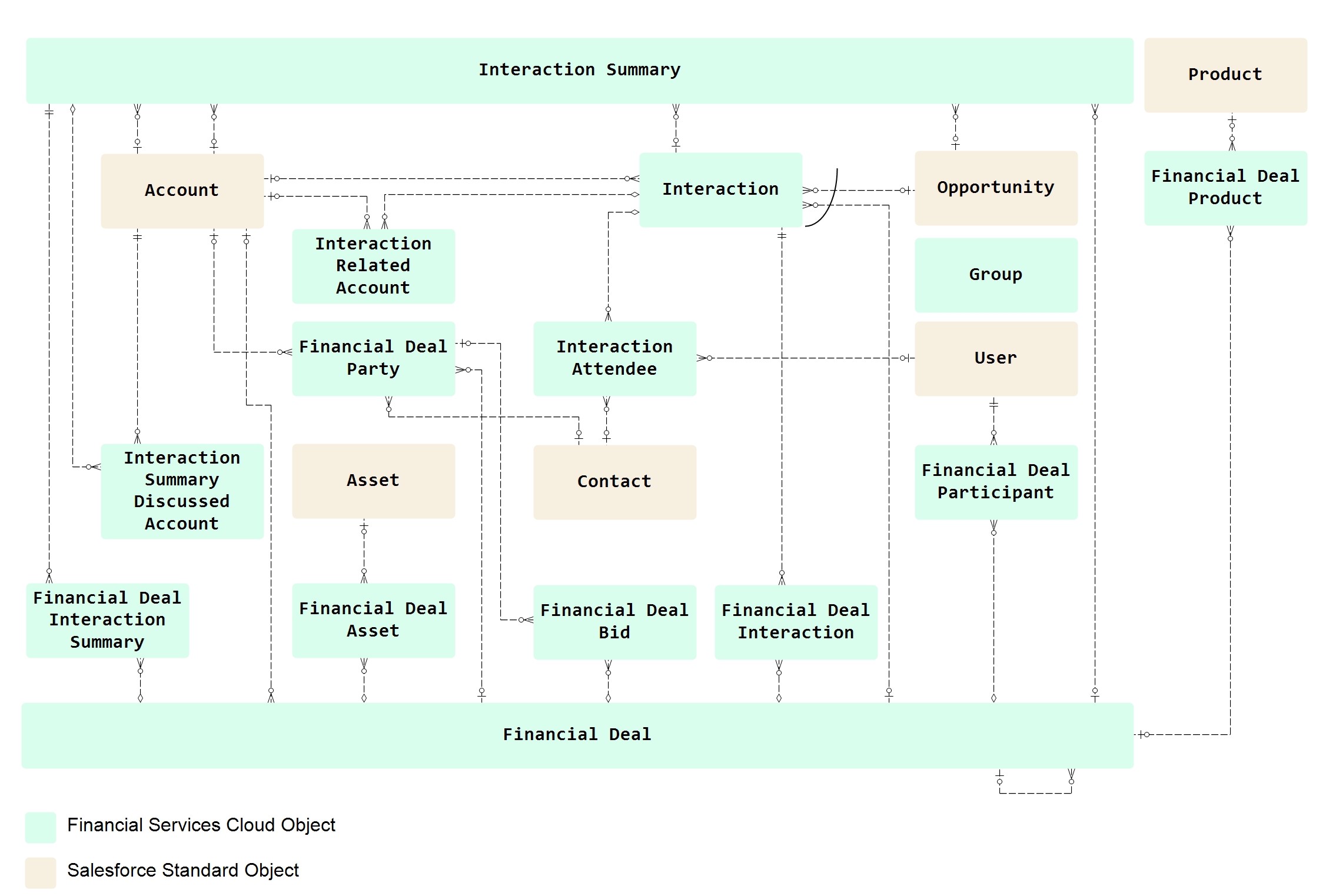

This diagram focuses on the structure and management of financial accounts within Financial Services Cloud. It illustrates how different entities like securities, transactions, alerts, and account roles are linked to a single financial account. It also shows the relationships between the financial account and associated products, assets, and parties, ensuring full transparency in account activities. The Financial Deal diagram provides an overview of how deals are structured and managed in Financial Services Cloud. It shows the relationships between financial deal participants, the involved assets, and any relevant products. This diagram is crucial for understanding the life cycle of a deal, from initial interaction through to the final agreements, with a focus on tracking financial outcomes and opportunities.

The Financial Deal diagram provides an overview of how deals are structured and managed in Financial Services Cloud. It shows the relationships between financial deal participants, the involved assets, and any relevant products. This diagram is crucial for understanding the life cycle of a deal, from initial interaction through to the final agreements, with a focus on tracking financial outcomes and opportunities. This diagram offers a high-level view of Salesforce Financial Services Cloud’s core components, including client profiles, financial accounts, deals, and transactions. It ties together the various elements that financial institutions manage within the platform, providing a comprehensive understanding of how data flows between different areas, enabling seamless customer service, compliance, and business operations.

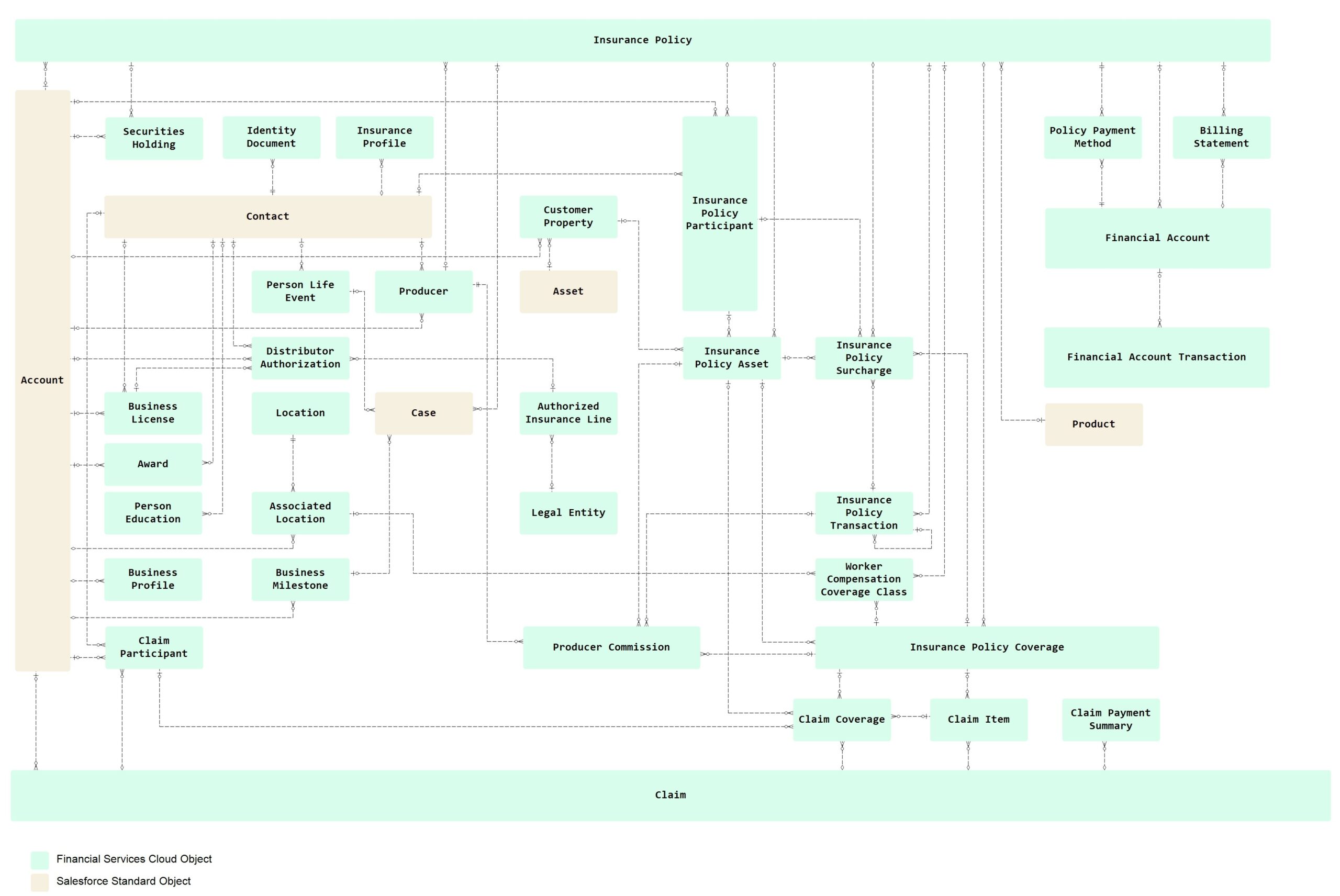

This diagram offers a high-level view of Salesforce Financial Services Cloud’s core components, including client profiles, financial accounts, deals, and transactions. It ties together the various elements that financial institutions manage within the platform, providing a comprehensive understanding of how data flows between different areas, enabling seamless customer service, compliance, and business operations. The Insurance diagram maps out the relationship between policyholders, insurance policies, claims, and related financial data. It shows how an insurance participant interacts with policies, coverage, and claims, while also illustrating the integration between financial accounts and policy transactions. This structure supports the management of customer policies, claim approvals, and premium calculations.

The Insurance diagram maps out the relationship between policyholders, insurance policies, claims, and related financial data. It shows how an insurance participant interacts with policies, coverage, and claims, while also illustrating the integration between financial accounts and policy transactions. This structure supports the management of customer policies, claim approvals, and premium calculations. This diagram focuses on summarizing the interactions between financial institutions and their clients or business partners. It highlights the relationships between accounts, contacts, interactions, and financial deals, capturing every point of engagement. This summary helps track communication history, follow-ups, and client discussions, ensuring that no interaction is missed in the service delivery process.

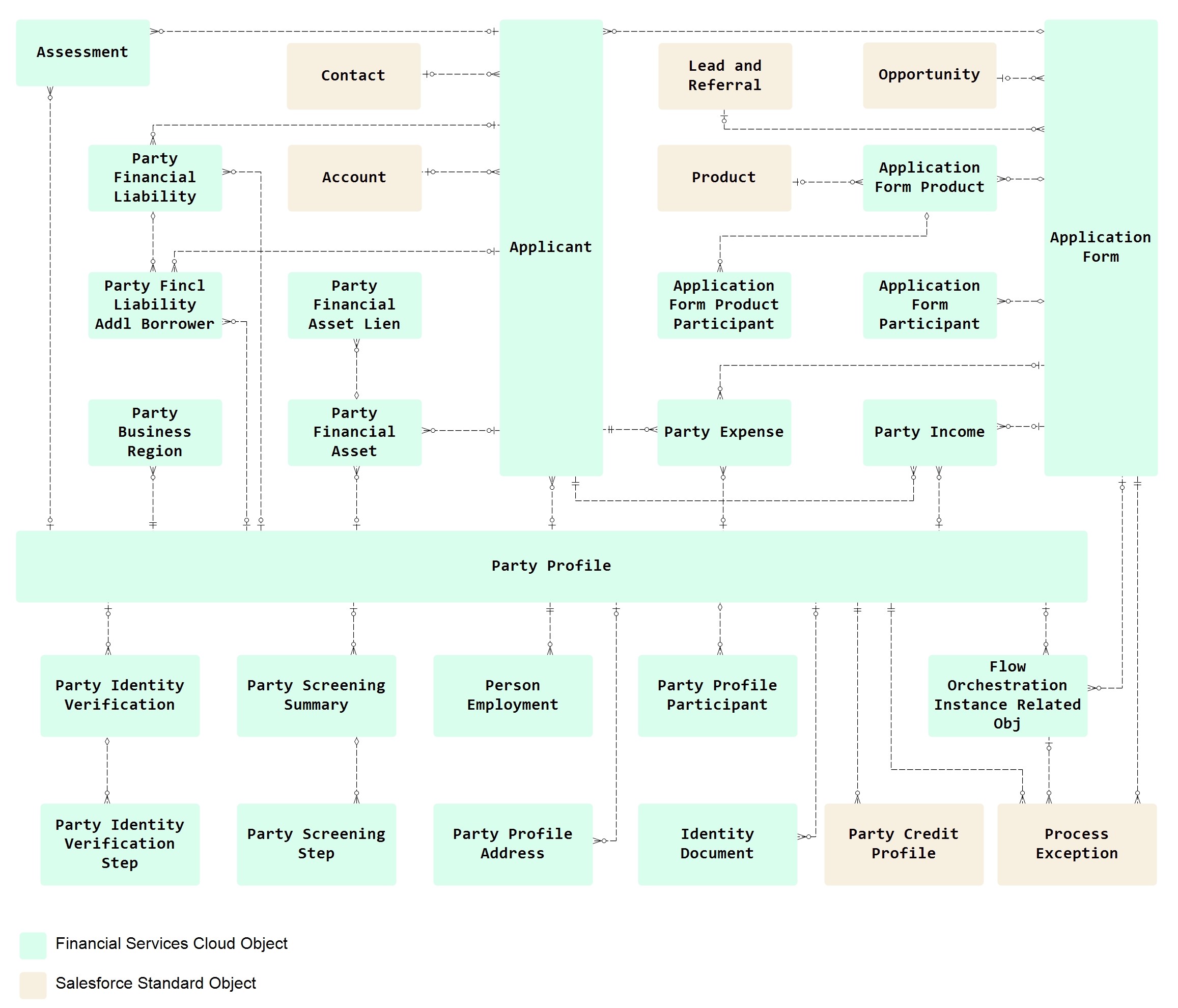

This diagram focuses on summarizing the interactions between financial institutions and their clients or business partners. It highlights the relationships between accounts, contacts, interactions, and financial deals, capturing every point of engagement. This summary helps track communication history, follow-ups, and client discussions, ensuring that no interaction is missed in the service delivery process. The Mortgage diagram outlines the process for managing residential loan applications within Financial Services Cloud. It shows the relationships between loan applicants, financial data, property details, and the loan application process. Key entities such as applicant income, liabilities, assets, and employment information are tied to the loan process, offering a full picture of how loans are assessed and managed.

The Mortgage diagram outlines the process for managing residential loan applications within Financial Services Cloud. It shows the relationships between loan applicants, financial data, property details, and the loan application process. Key entities such as applicant income, liabilities, assets, and employment information are tied to the loan process, offering a full picture of how loans are assessed and managed.